Introduction

In the ever-evolving world of finance, new investment opportunities continually arise, capturing the interest of investors. One such opportunity that has been gaining attention is SASA Share. But what exactly is SASA Share, and why is it becoming an important topic in the stock market? Let’s dive in to understand its nuances.

Understanding SASA Share

Definition and Overview

SASA Share is a unique type of financial instrument that represents ownership in a company. Unlike traditional shares, SASA Shares are designed to offer certain benefits and features that cater to specific investor needs. They provide a flexible and innovative way for companies to raise capital while giving investors various options to tailor their investments.

Key Features of SASA Share

Some of the standout features of SASA Share include customizable dividend policies, enhanced voting rights, and tailored liquidity options. These features make SASA Share an attractive option for both companies and investors looking for more control and flexibility in their financial dealings.

History of SASA Share

Origins and Development

The concept of SASA Share originated in response to the growing demand for more adaptive and investor-friendly financial instruments. Initially introduced by forward-thinking companies, SASA Share has evolved significantly, incorporating feedback from the market to better serve its stakeholders.

Major Milestones

Over the years, SASA Share has achieved several significant milestones, including regulatory approvals, successful market launches, and widespread adoption by major corporations. These milestones have solidified its position in the financial market and continue to drive its growth.

How SASA Share Works

Mechanism and Functionality

SASA Share operates on a mechanism that combines traditional equity with modern financial engineering. Investors purchase SASA Shares similarly to regular shares, but with added features that can be activated based on predefined conditions. This mechanism ensures that investors have access to enhanced benefits while maintaining a level of security.

Key Players and Stakeholders

The primary stakeholders in SASA Share include the issuing companies, investors, regulatory bodies, and financial intermediaries. Each of these players has a crucial role in the functioning and success of SASA Share, ensuring that the interests of all parties are balanced and protected.

Benefits of Investing in SASA Share

Financial Advantages

Investing in SASA Share offers several financial advantages, such as potential for higher returns, diversified income streams, and better alignment with investor goals. These benefits make SASA Share an attractive option for those looking to optimize their investment portfolios.

Risk Management

One of the key benefits of SASA Share is its ability to manage risk effectively. The customizable nature of SASA Share allows investors to tailor their investments according to their risk appetite, thereby reducing exposure to market volatility.

Challenges and Risks of SASA Share

Potential Downsides

Despite its many advantages, SASA Share is not without its challenges. Investors need to be aware of potential downsides, such as complex structures, higher costs, and limited market understanding. These factors can affect the overall attractiveness of SASA Share for some investors.

Market Volatility

Like any financial instrument, SASA Share is subject to market volatility. Fluctuations in the market can impact the value and performance of SASA Shares, making it essential for investors to stay informed and prepared for such changes.

SASA Share vs. Traditional Shares

Key Differences

The primary difference between SASA Share and traditional shares lies in their structure and features. SASA Share offers more flexibility and customization, whereas traditional shares are more straightforward and widely understood.

Comparative Analysis

When comparing SASA Share to traditional shares, it’s important to consider factors such as risk, return, liquidity, and investor control. SASA Share tends to offer more control and potential for higher returns, while traditional shares provide stability and simplicity.

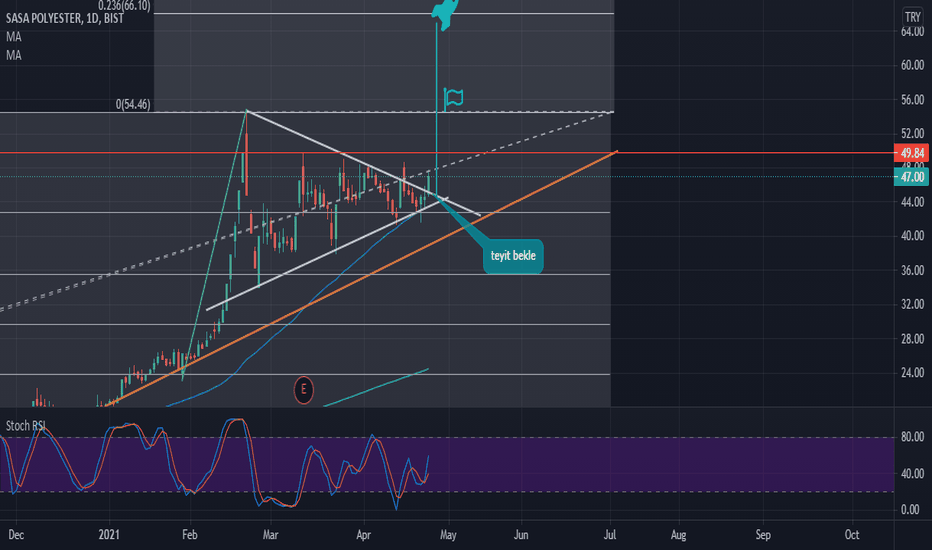

Market Performance of SASA Share

Historical Performance

Historically, SASA Share has shown promising performance, often outpacing traditional shares in terms of returns and growth. However, its relatively new presence in the market means that long-term performance data is still limited.

Recent Trends

Recent trends indicate a growing interest in SASA Share, with more companies adopting this financial instrument and investors showing increased willingness to explore its benefits. These trends suggest a positive outlook for the future of SASA Share.

How to Invest in SASA Share

Step-by-Step Guide

Investing in SASA Share involves a few key steps:

- Research: Understand the fundamentals of SASA Share and identify potential opportunities.

- Consult: Seek advice from financial experts to evaluate the suitability of SASA Share for your portfolio.

- Purchase: Buy SASA Shares through a brokerage or investment platform.

- Monitor: Regularly review the performance of your SASA Shares and adjust your investment strategy as needed.

Tips for Beginners

For beginners looking to invest in SASA Share, it’s crucial to start with thorough research and consult with financial advisors. Diversifying your investment and staying updated on market trends can also help mitigate risks.

Regulatory Aspects of SASA Share

Legal Framework

The regulatory framework for SASA Share varies by region but generally includes guidelines for issuance, trading, and investor protection. Compliance with these regulations is essential for the smooth functioning of SASA Share.

Compliance Requirements

Issuing companies and investors must adhere to specific compliance requirements, such as disclosure norms, reporting standards, and anti-fraud measures. These requirements ensure transparency and protect the interests of all stakeholders.

Expert Opinions on SASA Share

Analysts’ Insights

Financial analysts often view SASA Share as a promising investment option due to its innovative features and potential for high returns. However, they also caution that investors should be aware of the complexities and risks involved.

Future Predictions

Experts predict that SASA Share will continue to grow in popularity, driven by ongoing innovation and market demand. The future looks bright for SASA Share, with many expecting it to become a standard offering in the financial market.

Case Studies of SASA Share

Successful Investments

Several case studies highlight the success of SASA Share investments. These examples demonstrate how investors have leveraged the unique features of SASA Share to achieve significant financial gains.

Lessons Learned

From these case studies, investors can learn valuable lessons about the importance of due diligence, risk management, and strategic planning when investing in SASA Share.

Technological Innovations in SASA Share

Impact of Technology

Technology has played a crucial role in the development and success of SASA Share. Innovations such as blockchain, AI, and data analytics have enhanced the functionality and security of SASA Share, making it more attractive to investors.

Future Prospects

The future prospects for SASA Share are closely tied to ongoing technological advancements. As technology continues to evolve, SASA Share is likely to benefit from improved efficiency, transparency, and accessibility.

Global Perspective on SASA Share

International Market

SASA Share has garnered interest from international markets, with many countries exploring its potential. This global perspective highlights the versatility and wide appeal of SASA Share as a financial instrument.

Comparative Analysis

A comparative analysis of SASA Share in different markets reveals variations in adoption rates, regulatory environments, and investor preferences. Understanding these differences can provide valuable insights for investors looking to diversify globally.

Conclusion

In conclusion, SASA Share represents a significant innovation in the financial market, offering unique benefits and opportunities for both companies and investors. Its flexible and customizable nature makes it an attractive option for those looking to enhance their investment portfolios. However, like any investment, it comes with its own set of challenges and risks that must be carefully considered.

FAQs

What is SASA Share? SASA Share is a financial instrument that offers unique features such as customizable dividend policies and enhanced voting rights, providing more flexibility and control to investors.

How can I invest in SASA Share? To invest in SASA Share, you need to research potential opportunities, consult with financial experts, purchase SASA Shares through a brokerage, and monitor their performance regularly.

What are the benefits of SASA Share? Benefits of SASA Share include potential for higher returns, diversified income streams, better risk management, and enhanced investor control.

Are there any risks associated with SASA Share? Yes, risks include market volatility, complex structures, higher costs, and limited market understanding.

How does SASA Share compare to traditional shares? SASA Share offers more flexibility and potential for higher returns, while traditional shares provide stability and simplicity.